Omnichannel, Google Shopping, Brand Generations

By Cleveland AdminAmazon and Walmart.com Shoppers Use Both Digital and In-Store Resources for Research

Stores remain an integral part of the product research process as well as a shopping destination for both Amazon and Walmart.com shoppers, especially when it comes to the consumables and home improvement categories. Over 50% of both cohorts report frequently purchasing in store when researching online. However, these consumers are using stores in tandem with digital channels like Amazon, Search, Social, and, to a lesser degree, Walmart.com. Our research has also indicated that many consumers, especially Millennials and Gen Z, are increasingly using mobile channels to do incremental research while in store as well. This is why it’s important to have consistency of branding, content, assortment, along with healthy in-stock levels across your digital and physical sales venues. We recommend ensuring that you consistently update and syndicate product detail content across eTailers, as well as leveraging in store messaging to take advantage of your digital presence where possible.

Google Overhauls eCommerce Platform

Google announced late last week that it was updating its eCommerce Platform, Google Shopping, in advance of the upcoming holiday shopping season. This update includes personalization of the homepage to offer product suggestions and reorder common purchases, as well as Omnichannel purchasing (including in-store pickup or delivery) directly through the Google platform, with a satisfaction guarantee from Google. The search giant also updated it’s mobile visual search platform, Google Lens, with more eCommerce offerings within Apparel. This comes as Google increasingly looks to compete with Amazon through partnerships with retailers and brands and capture a larger portion of the growing eCommerce market.

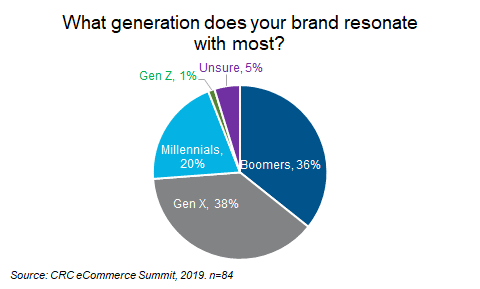

Brands Resonating with Multiple Generations

Feedback from our eCommerce Summit indicates that brands are resonating with a variety of generations, including a roughly equal split across Boomers, Gen X, and Millennials. In contrast, only 1% of brands felt like they resonated most with Gen Z. According to our research, this youngest generation, like Millennials, uses social media for shopping at much greater rates than prior generations, suggesting an opportunity to link inspiration and brand awareness campaigns on social media to transacting. It also suggests shoppable offerings will continue to advance on social media as these platforms look to keep transactions on their sites/apps and capitalize on this shopping behavior.