Food and CPG Sales Surge; Amazon Warehouses; Purchase Order Declines

By Cleveland AdminOur recent COVID-19 benchmark indicates that food & consumables manufacturers are seeing a surge in demand on Amazon during March and are increasing their 2020 growth forecasts on the account. All food manufacturers and two-thirds of consumables manufacturers have seen higher demand than expected under normal conditions, with nearly 70% of food vendors seeing 50%+ better demand than expected. Most surveyed manufacturers have not yet adjusted full year growth rates due to continued uncertainty around the duration of the pandemic and the impact to sales once it subsides. The current crisis may very well be a positive exogenous shock driving greater adoption to online grocery shopping longer term, benefiting Amazon and its online grocery rivals.

Amazon Plans on Adding 100k New Warehouse and Delivery Jobs; Warehouse Worker Tests Positive for Covid-19

In Amazon’s update on its COVID-19 response, the eTailer noted that it planned on adding 100,000 full and part time employees to its fulfillment centers and delivery networks in order to meet the surge in eCommerce demand. This could help to provide an offset to potential job losses in hard hit areas of the economy such as food service, hospitality, and entertainment. As a potential headwind to this initiative, news reports this morning indicate that the first Amazon warehouse employee tested positive for COVID-19 at a New York warehouse. Amazon has closed the warehouse temporarily for additional sanitation, and has not indicated when the facility will reopen.

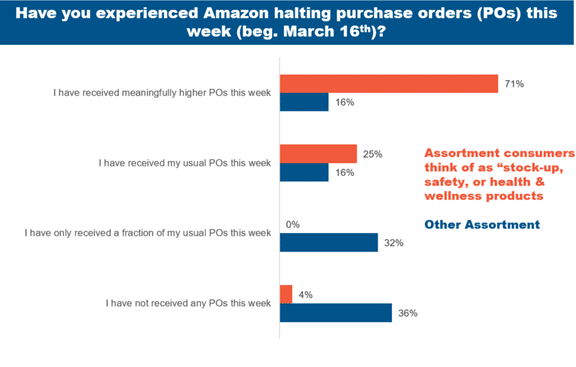

Amazon POs Drop for Non-Essential Items

Our Amazon COVID-19 Benchmark indicates that 60%+ of “non-essential assortment” vendors saw a dramatic drop in purchase orders this week, as Amazon focuses its purchase activity on high demand items during the outbreak. Amazon has indicated that this is likely to continue at least through April 5th, creating out of stock risk for many of these vendors.