Amazon Fresh Stores; Walmart Distribution Centers; eCommerce Growth in 2021

By Cleveland AdminAmazon has launched five Fresh (“Mendel”) B&M stores to date, including four in California and one in Illinois. The Amazon Fresh team appears to have ambitious goals for store expansion this year (indicating to many brands that it plans to open 100+ stores this year), and has suggested these B&M stores could account for 50%+ of growth in the business during 2021. While many brands do not necessarily think Amazon will be able to build that many stores, they tend to be very focused on supporting the effort, particularly in terms of helping the Amazon team develop assortment and pricing strategies for a B&M environment

Source: About Amazon

Walmart Leveraging its Store Footprint with Local Fulfillment Centers:

One of Walmart’s digital strengths is its existing physical footprint across the United States, enabling delivery to the home and pick up options. Building on this strength, Walmart announced it is planning to create warehouse space within existing store footprints or built on as an expansion to stores. These warehouses are being referred to as “local fulfillment centers” and will include frozen capabilities. Walmart cites benefits including reducing foot traffic from associates picking items alongside regular consumers in the store, in addition to greater availability and faster fulfillment. In our consumer study conducted in July, Walmart ranked the lowest on assortment availability and delivery/pickup experience (although by a small margin) compared to some of its grocery peers, and this latest announcement may help improve these scores as they expand.

Source: Walmart

eCommerce Penetration Poised to Grow in 2021:

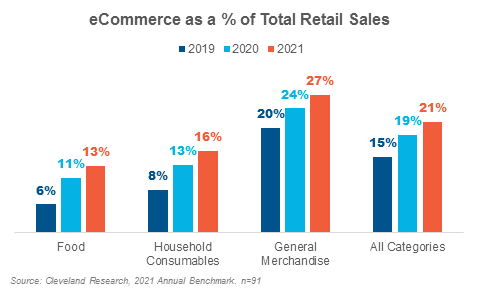

According to our most recent benchmark, manufacturers expect eCommerce to continue grow as a percentage of their total retail sales in 2021. Manufacturers in food, consumables, and general merchandise categories, on average, expect eCommerce to gain another 250 basis points of share in their total retail mix, compared to the typical 100 basis point expansion the industry experienced pre-pandemic. The positive outlook from brands suggests they expect a high degree of online retention even as more of the population is vaccinated against Covid-19 throughout the year.