Strong Amazon Demand; Target’s Same-Day Delivery Services; Q4 Digital Sales

By Cleveland Admin

Our research suggests demand trends remain very strong 1Q to-date and brands and Amazon management alike expect elevated demand to continue for the near term at least. In many categories, Amazon appears to be ordering aggressively in 1Q as it works its way back to healthier in-stock levels. While in-stocks are improving, most brands still expect demand to outpace supply through at least the first half of 2021, as raw materials, manufacturing processes, and transportation remain constrained. Further, many brands continue to point to extended lead times and logistical challenges on Amazon’s end, namely missing pickup appointments and extended timeframes for Amazon receiving inventory into the FCs.

Target’s Same Day Services Up 235%:

Target had a strong year overall and a strong Q4 in particular, gaining $9 billion of market share total ($3 billion in 4Q alone). Target’s digital sales grew by nearly $10 billion in 2020, driven by 235% growth in the company’s same-day services. It was noted that in Q4, more than 95% of Target’s fourth quarter sales were fulfilled by its stores. Target also announced it will invest ~$4 billion annually during the next several years to improve capabilities including enhancing fulfillment services which is top of mind for competitors as well.

Source: Target

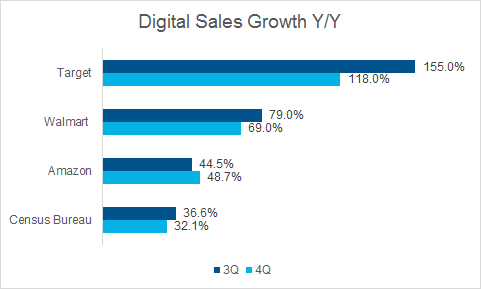

Q4 Digital Sales:

Retailers saw strong digital sales as a result of the COVID-19 crisis. Digital demand for companies like Amazon has remained elevated due to consumers’ avoidance of B&M stores. While the demand outlook is quite positive, brands are beginning to see greater profitability pressure from their omnichannel customers and many expect that to continue throughout the year. Walmart and Target are common examples of omnichannel stores that have reached out seeking concessions specifically as a result of increased costs tied to the pandemic. On the other hand, Amazon demand trends benefit from consumers’ growing accustomed to making regular purchases online.

Source: Census Bureau, Company Filings & CRC Estimates