Amazon Invests in Rx & Prime Day Inventory; Price Increases to Continue in 2021

By Cleveland Admin

Amazon is looking to expand within the U.S. pharmacy and virtual care markets. Our research indicates the company’s current priority within that space is to have their digital capabilities fully vetted prior to partnering/buying brick and mortar assets. We believe a central part of Amazon’s pharmacy strategy is Amazon Care, with the most attractive offer being a 2-hour prescription delivery for members. The offering is currently only available to Amazon employees in the Seattle area via Bartells. As the 2-hour prescription delivery expands to more markets (for either Amazon employees or other employers), Amazon will need to expand their local infrastructure which will likely require them to partner with more brick and mortar pharmacies. Our research also suggests Amazon is in the process of building 4-6 additional central fill/mail order facilities (PillPack currently has 5-6 mail order facilities today) to both expand their capacity for real-time delivery in more markets.

Source: Amazon

Prime Day:

Amazon confirmed a 2Q Prime Day in their most recent earnings call and just this week specified that the event will occur on June 21st and 22nd. Amazon appears to be preparing for Prime Day by slowing orders on non-Prime Day items to make room in its fulfillment centers for Prime Day inventory. Some brands have reported they are experiencing challenges with significant inventory drawdown on many items and therefore are concerned about having enough supply to meet the eHoliday demand. Last year’s Prime Day appeared to be relative;y successful for Amazon and its brand partners, and this year, according to our benchmark, a net 5% of Food & CPG manufacturers and a net 22% of general merchandise manufacturers expect to spend more on Prime Day compared to Prime Day spend in 2020.

Source: About Amazon

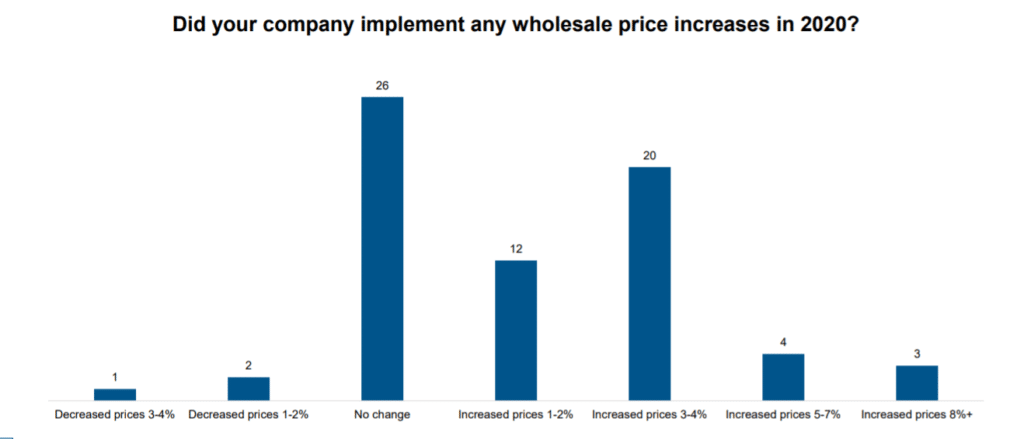

Price Increases: Our research indicates 54% of suppliers implemented a price increase in 2021 thus far with more suppliers planning to do so throughout the remainder of the year. Feedback on Amazon’s reaction to a price increases has been mixed, with the retailer being seemingly more difficult to navigate than others. Our benchmarking data also shows that Walmart and Amazon outpace other accounts as the highest costs to serve in 2021.

Source: CRC May 2021 Input Cost Supplier Benchmark Survey, n = 66