eCommerce Supply Chain – Capability Investments; Grocery Delivery; Fulfillment Evolution

By Cleveland Admin

Only 26% of brands report bringing a “strategic approach” to eCommerce operational investments. When it comes to brands’ eCommerce supply chain, 74% of companies report approaching operational capability investments with a “tactical mindset.” This would require significant business volume to validate investments, addressing issues in a reactionary manner, and focusing on conventional B&M operations. Our eCommerce Packaging & Supply Chain Benchmark encourages companies to adopt a more strategic mentality. This is because we believe the brands that are strategically investing in supply chain capabilities will be better positioned for long-term success.

Source: Pattern

Uber partners with Costco & Albertsons to provide grocery delivery capabilities to over 400 locations: The pandemic created a lasting need for retailers to get product to consumers as fast as possible and in whatever way they prefer. Uber appears to be investing in this strategy in a big way, announcing this week a partnership with Costco in 25 Texas locations, just after announcing a partnership with 1,200 Albertsons’ owned stores (such as Safeway, ACME and Randalls). DoorDash also announced a similar partnership with Albertsons in June. These announcements reiterate the robust fulfillment capabilities that are needed to succeed in eCommerce today, often times resulting in retailers turning to creative partnerships like Uber and DoorDash. As we emphasize above and in our recent benchmark, we believe suppliers will also see greater success when they focus on advancing their own eCommerce supply chain capabilities in a consumer-focused and forward-looking manner.

Source: Store Brands

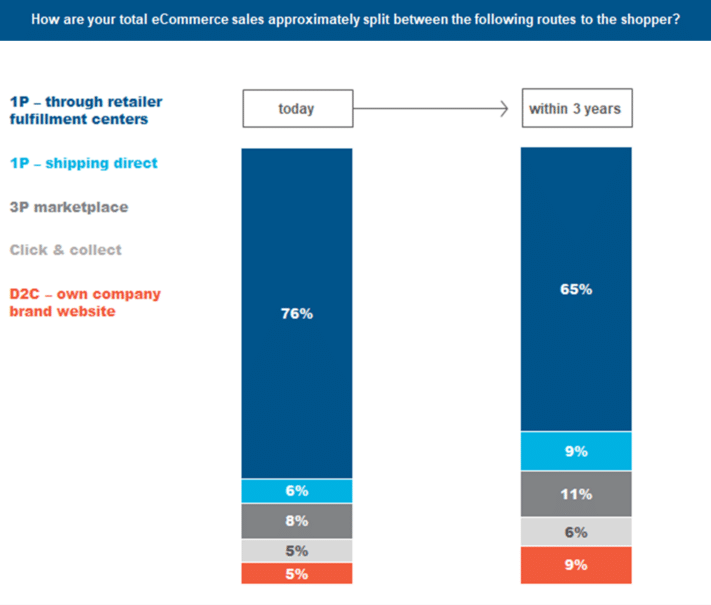

Brands plan to decrease reliance on fulfillment centers within the next 3 years:

Our recent supplier benchmark suggests over 75% of eCommerce volume today is going through retailer fulfillment centers. However, brands project that will decline by 11 points within the next three years, in favor of more emerging routes such as 1P drop ship (+3 points), 3P marketplaces (+3 points), click & collect (+1 point), and D2C (+4 points). This expected evolution will require an involved eCommerce supply chain, again helping to illustrate the need to accelerate forward-looking investments related to packaging, warehouse operations, logistics systems, and fulfillment.

Note: “1P – shipping direct” includes drop shipping / Direct Fulfillment, Vendor Flex, etc.

Source: CRC Packaging & Supply Chain Benchmark, n=46