Amazon Supersedes Walmart; Growth Forecasts for 2021

By Cleveland Admin

Earlier this week Walmart reported their 2Q FY2022 earnings, bringing their total sales for the last year (ending in July) to $566 billion. Comparatively, Amazon made history this quarter by boasting an estimated $610B in total sales in the same time period, surpassing Walmart as the largest retailer in the world (not just online), outside of China/Alibaba which remains #1. This shift comes after the pandemic accelerated eCommerce 4+ years into the future, with Amazon ultimately coming out on top.

Amazon’s sheer size is a force to be reckoned with. Our 2021 eCommerce Retailer Forecasts pegs Amazon’s North American gross merchandise value (GMV) growth at 19%, which would equate to over $57B in incremental growth. That compares to an incremental $19B for Walmart’s total US business. Looking at eCommerce specifically, it compares to $6.5B in incremental Walmart.com sales and even exceeds the incremental growth of all other pure play eTailers forecasted in the report combined (an estimated $56B when summing Big Commerce, Chewy, eBay US, Shopify, and Wayfair).

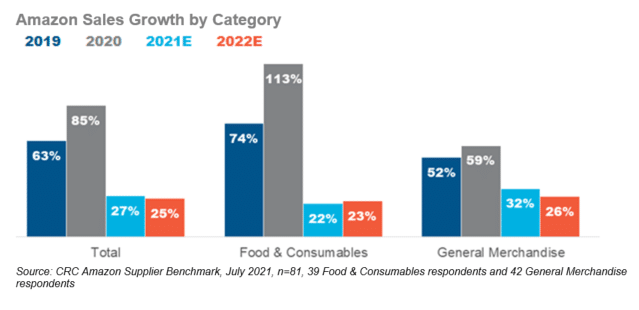

Brands forecasting 27% growth on Amazon for 2021, compared to 85% growth in 2020:

According to our most recent Amazon Supplier Benchmark, brands are expecting 27% growth on Amazon this year. While this is a significant moderation from the pandemic-driven growth rates of 2020, we still see it as solid growth given the tough comparisons. Broken down by category, Food & Consumables brands expect 22% growth compared to General Merchandise brands at 32% growth. On top of the relatively tougher comparisons, Food & CPG brands are up against vs. General Merchandise brands, some of the disparity in growth rates could also driven by Amazon’s recent purchase order patterns. Food & CPG brands saw significantly lighter POs from Amazon in May and estimate that Amazon is holding 20% less inventory than normal, on average, compared to 9% less inventory for General Merchandise brands. Heading into the eHoliday season, brands are hopeful for a ramp up in ordering and are adjusting their supply chain and inventory accordingly.