Amazon Live & OTT Tests Expanding; eCom Agency Partners; Chewy 4Q21 Results

By Cleveland AdminAmazon Live & OTT Tests Expanding:

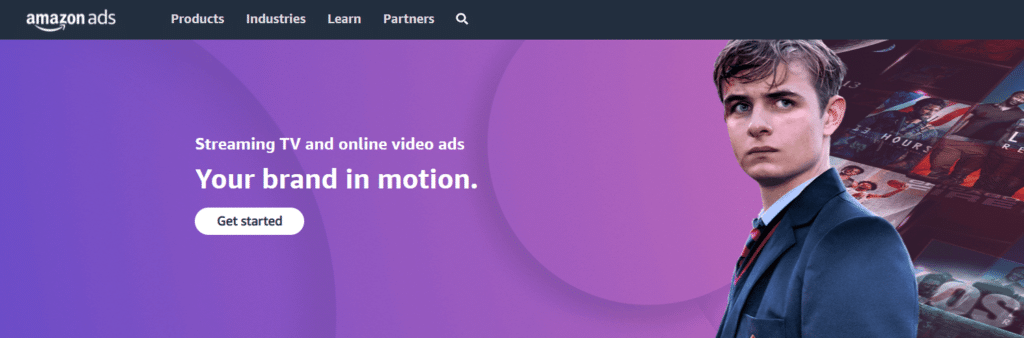

This week we released our latest update on Amazon Advertising. In our research we found that Amazon Live videos appear to be getting more adoption and investment. These shoppable livestreams have gained traction throughout the holiday season and Amazon’s competitors like Walmart have been moving towards similar shopper experiences. In addition to more display ads on-site, more brands are testing with Amazon’s DSP platform in 2022 to run OTT campaigns. These ads are often times run on Amazon’s owned live video streaming companies like IMBDtv and Twitch or leverage the companies Fire Stick/TV.

“When your agency partnership has gone stale”:

Throughout the pandemic, brands raced to see who could digitize their business the fastest, capitalizing on the at-home consumer. Bringing in key strategic ecom service providers was a huge part of that restructure. Now that we are inching away from the pandemic, some vendors are faced with the tough decision of figuring out if their external partners will work for them in the long-term. Code3, one of CRC’s Thought Leader partners, encourages brands to explore this issue and ask themselves key questions surrounding whether it is time to find a new partner. The overall takeaway is to find a partner who can be just as innovative, passionate, communicative, and transparent as an internal team member would be so that you can grow your businesses together. And if results are not up to par, don’t be afraid to find a new agency. Click here to learn more.

This pairs nicely with the Agency Decision Matrix covered during CRC’s 2021 Virtual eCommerce Summit, which helps walk brands through a framework to find the right agency fit for their organization.

Note: To access the video replay, please enter your work email address that you previously registered with for the summit or simply respond to this email for assistance.

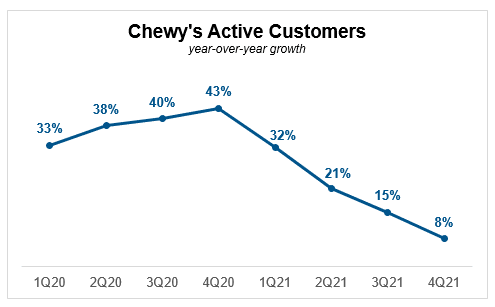

Chewy reports 4Q21 results; Supply chain continues to limit sales and profitability:

Sales in the quarter increased +16.9% Y-Y. Management stated that out-of-stocks in the quarter were 2x higher than expected due to Omicron and supply chain difficulties (sales would have been closer to +19% without challenges). Also, expected net active customer adds and retention was weaker than expected. Chewy grew active customer 8% in 4Q compared to +20% through the first 9 months of the fiscal year. The company explained the softer growth was driven by weaker than expected retention from the 4Q20 cohort due to stimulus checks and the second wave of COVID. Gross margins missed expectations primarily driven by price on Chewy lagging retail price increases and higher inbound freight costs. Our Pet Insights Council’s research suggests product mix will continue to be a headwind in the near term as Hardgoods remains softer due to weakening customer discretionary spend, reduced promotions, and less new pet benefit. Longer term, we continue to see Chewy as well positioned to gain share in the pet industry and see several drivers to improve top and bottom line performance within healthcare, advertising, and private label expansion.