Amazon shortage deductions, Amazon’s DSP, Truckload cost inflation

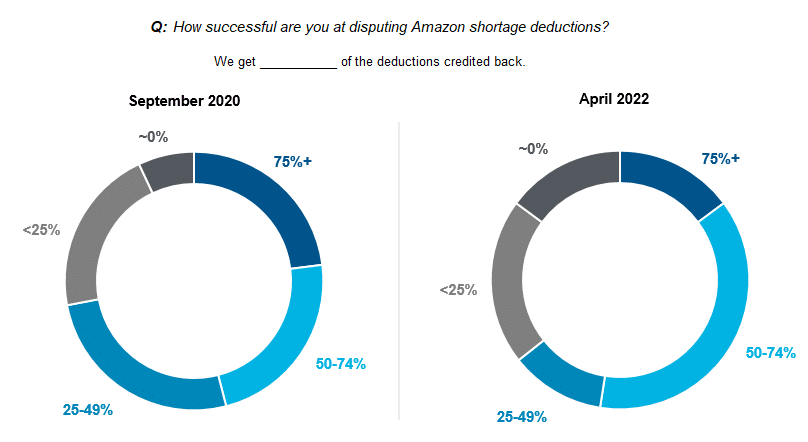

By Cleveland AdminSome brands having more success with Amazon chargebacks:

In our LiveCast yesterday we polled our community and found 53% of brands are successful in receiving 50% or greater of Amazon deductions credited back. This is a slight improvement compared to the 46% of brands which indicated a 50% or better success rate during a similar survey in September 2020. While this is encouraging to see, we have still heard in our broader research over the last 6-9 months brands have been seeing an influx of shortages and chargebacks. Overall, the dispute process can sometimes take months and it is viewed as a time and resource intensive commitment (with high opportunity cost) for most brands. See our report published at the end of 2021 for some tips and tricks on how to handle this issue.

Amazon’s DSP platform is attracting incremental dollars from brands:

In our research we continue see brands allocate the majority of their ad dollars towards Amazon’s Console (AMS). Although, recently there seems to be more interest from vendors to grow their DSP placements for each incremental ad dollar going towards Amazon. In prior editions of 3 Things, we touched on how OTT advertising is expanding through Amazon’s DSP, but that is simply one of the ad types offered on the software. Other online display, video, and audio options are available. This ties into another theme that has come up in our research which is the continued emergence of non-endemic advertising, especially on Amazon’s DSP. Given challenges in social advertising following Apple’s iOS privacy updates, Amazon DSP seems to be a great option for both brands and other advertisers that are not even selling on Amazon.com.

Truckload cost inflation is likely near its peak; it may be time to reevaluate rates:

In CRC’s latest Transportation and Logistics report, the biggest takeaway is that truckload cost inflation (excluding fuel) is likely near peak, and shippers/customers might want to consider refreshing rates to find incremental cost savings opportunities going forward. CRC’s transportation research team believes shippers could lower their truckload costs in 2022 primarily through lower spot market and broker-sourced capacity, which likely drop 0-5% in 1H22. As more brands continue with Amazon AVNs and other customer negotiations, supply chain rates remain one of the top discussion points.