Consumer Spending, Amazon vs. Homecenter Growth, Amazon Ordering

By Cleveland AdminConsumer spending habits:

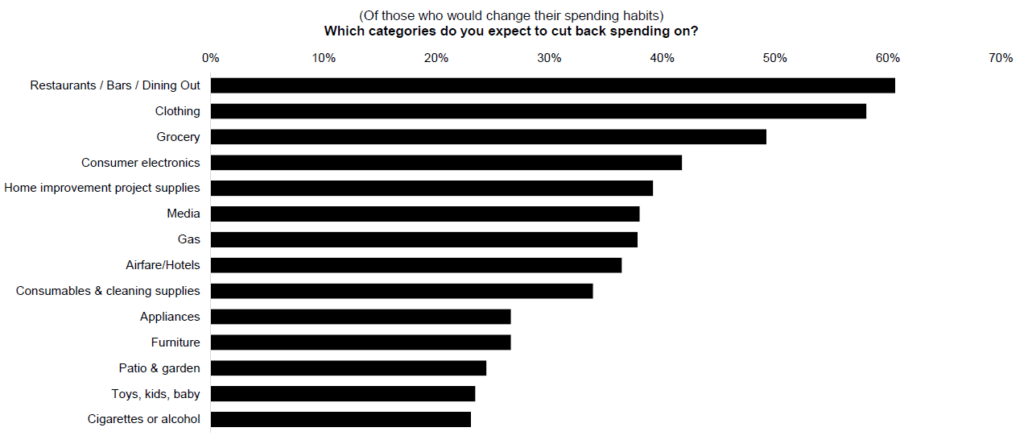

In our latest consumer study, 85% of shoppers reported that they plan to change spending habits by reducing expenditures if inflation continues. The 15% not planning to change spending habits credited excess savings. For those looking to reduce spend, consumers reported that likely cutting back first on restaurants, bars, and dining out, followed by clothing, and then grocery. Looking at the data by generation, the survey also found older consumers were more likely to cut back on spending. Lastly, results showed more than half of consumers claim that they ‘tend to search for deals or promotions’. This is aligned with our recent research showing consumers have responded favorably to dealing /discounts.

Amazon vs. Homecenters online growth:

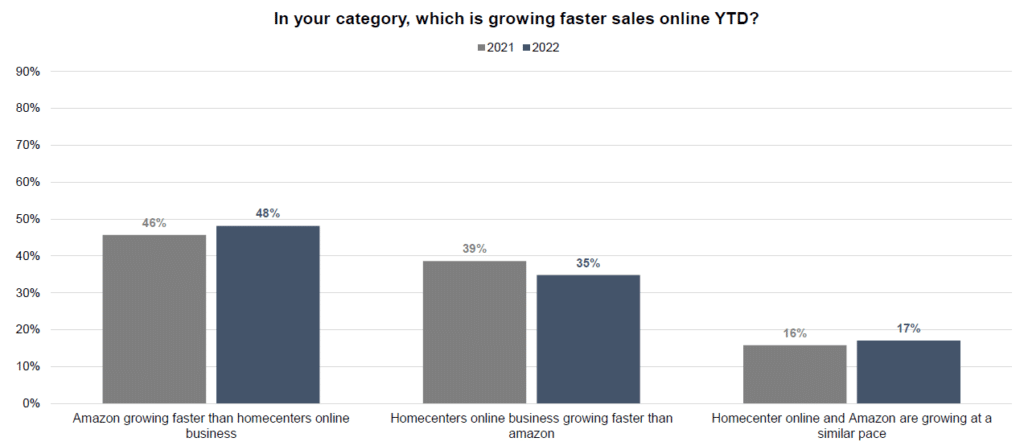

In a recent study published by our Home Improvement team, a net 13% of vendors reported that their Amazon businesses are growing faster than their Home Depot.com and Lowe’s.com businesses in 2022. This compares to net 7% of brands last year. More specifically, when looking at DIY brands a net 20% saw faster Amazon growth while PRO vendors were split with results net neutral between Amazon and homecenter website growth. Check out the report for further splits between price point, private label, seasonal items, and category.

Amazon ordering patterns choppy:

As we called out in our most recent Amazon update, some vendors had yet to see replenishment orders after a stronger-than-expected Prime Day. Since then, many account managers are still not seeing typical weekly replenishment POs come through, and this has some vendors worried about whether or not they will be able to keep up with holiday demand (especially considering the Prime Day-like event taking place in a few weeks). In addition to potential backlogs and capacity issues within Amazon’s supply chain, this also likely reflects Amazon making sure its inventory is right-sized to reflect a more competitive retail environment and potentially softer consumer outlook.