Amazon 1Q Results; In-Garage Delivery Expands; Sales in Canada Decline

By Cleveland AdminOutside of its physical stores segment, which is driven by Whole Foods, Amazon delivered steady to accelerating growth rates in all of its business segments, with both N. America and International markets performing well. These results are even more impressive considering 4Q20 benefited from Prime Day falling in the quarter, making the comparison more difficult. In N. America, we estimate Amazon’s GMV grew an incremental $29 billion dollars during the quarter, while it delivered an incremental $18B in International markets. The company also delivered better than expected profitability, with retail operating profits of $4.7B, up from $914mm a year ago.

Amazon Expands Availability of In-Garage Delivery:

Key by Amazon, which is the company’s in-garage delivery program, has expanded from only five cities to the 5,000+ U.S. cities where Amazon offers grocery delivery. Amazon’s press release cites convenience as consumers’ primary reason for continued use of grocery delivery post pandemic, which aligns with the findings from our online grocery satisfaction study. The study suggests convenience and time are top reasons for using online grocery services a year from now. In-garage delivery, which is free to Prime members (who have a compatible garage door opener), it is just another way for the eTailer to serve the consumer in their preferred way.

Amazon Canada:

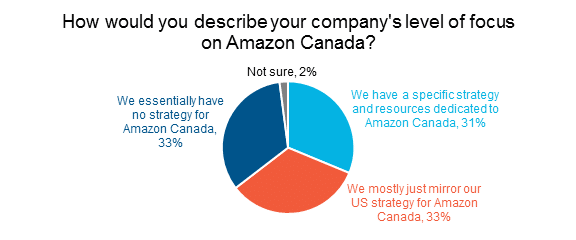

According to our most recent benchmark, Canada contributes low- to mid-single digits of total sales to manufacturers’ North American Amazon business. Manufacturers are almost evenly split in terms of their level of focus for the region, mostly mirroring the breakdown of how important it is for their growth plans. To help grow this business, approximately two-thirds of companies have a separate team manage this segment, while the balance use the same team that manages the Amazon U.S. business.

Source: CRC Amazon Benchmark, April 2021, n=41