Amazon Advertising Challenges; Amazon Store & Posts; Retail Foot Traffic

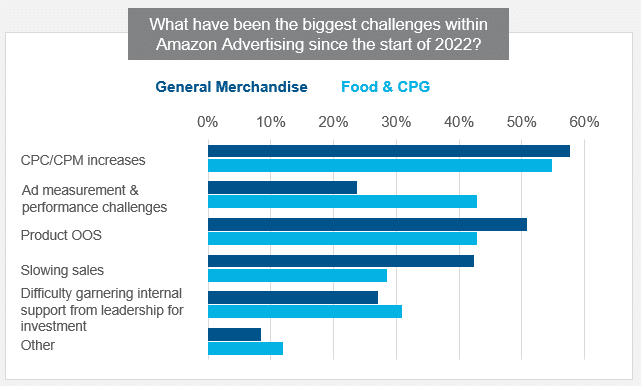

By Cleveland AdminIncreased cost to advertising on Amazon is top challenge for brands year-to-date:

In our 2022 Amazon Advertising benchmark we found that over half of General Merchandise and Food & CPG brands reported that CPC/CPM increases have been the biggest challenge within Amazon Advertising since the start of 2022. For General Merchandise brands this was followed by product out-of-stocks and slowing sales. For Food & CPG brands product availability along with ad measurement / performance challenges were the biggest issues brands were currently dealing with on the eTailer’s advertising platform. To help offset rising costs, and improve efficiency we see brands are getting creative to drive awareness such as leveraging Amazon posts which are a free advertising tool that often attract new customers to explore your products.

Stay tuned for the full release of our 2022 Amazon Advertising benchmark in the coming weeks!

Content considerations – Amazon store & posts playbook:

CRC’s Thought Leader partner, Retail Bloom, has released a white paper on the importance of the free attributes: Amazon brand stores and posts. In the paper, Retail Bloom dives into how creative content like these two placements can increase customer loyalty as well as allow the shopper to view all of a brand’s catalogue at once and get a feel for the brand. In fact, 90% of the top performers on Amazon have either launched or maintained an existing store. Those brands that put even more effort into the Amazon store tend to see higher shopper dwell time and higher attributed sales per visitor. Although Amazon brand stores are a free tool, they can take a lot of time to set up and maintain. Retail Bloom recommends that brands: 1) provide a quarterly store refresh, 2) add a brand follow banner onto the page, 3) lead with “add to cart” buttons, 4) test bundles, and 5) add store performance to your brand’s KPIs. Amazon posts take a similar effort to social media posts and can also boost shopper engagement.

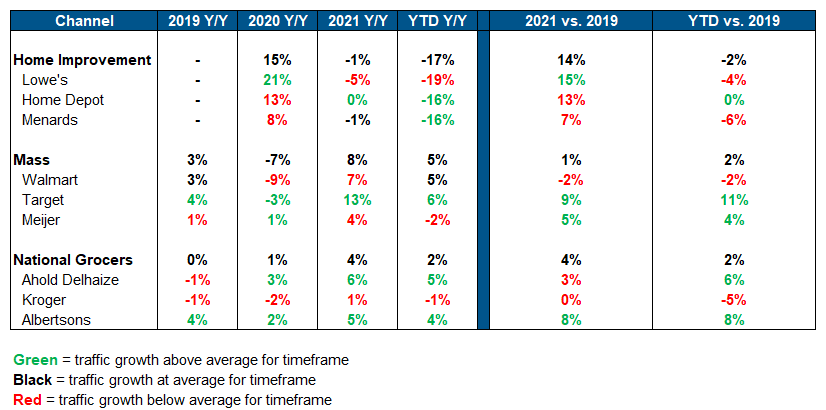

Retail foot traffic: home centers seeing a reversion to 2019 trends while mass and grocery traffic still growing:

In our latest retailer traffic reports (home improvement & traditional retail) we have found that home improvement retail food traffic has slowed year-over-year, returning to 2019 levels likely due to shoppers returning to their daily pre-COVID routines and a lack of government stimulus checks. At the same time, mass and grocers are seeing foot traffic growth YTD compared on both a year-over-year and 2019 basis. For mass and grocery, this highlights a reversion to in-store shopping following the acceleration of eCommerce penetration during the pandemic. In the near-term we continue to expect ecommerce growth to be softer in 2022 compared to the two years prior. Thus, in order to maximize sales, brands must place an emphasis on providing a great in-store experience, matched with the convenience of e-shopping for an effective omnichannel strategy.