Amazon Vendor Negotiations; Costco Tests Curbside Pickup; Consumer Buying Behavior in Flux

By Cleveland AdminOver the last several years, many manufacturers have increased spend requests during their Annual Vendor Negotiations (AVNs). In our latest benchmark study, Amazon appears most focused on asking manufacturers to spend more on co-op, merchandising programs, and its SAS resource. Our study suggested food and consumables manufacturers have a larger increase in their core retail program (14% higher for ‘21, on average), compared to general merchandise manufacturers (6% higher for ’21, on average).

Source: MGM Insights

Costco Tests Curbside:

Costco announced its plans to test curbside pick-up at three stores in Albuquerque, New Mexico. The service will be enabled by Instacart, and the offering is an attempt at having a comparable offering to its rivals, BJ’s and Sam’s Club. Many retailers have leveraged Instacart partnerships to roll out curbside and delivery programs quickly. We will watch these partnerships closely to see how they evolve as the entity that owns the consumer relationship can therefore secure greater marketing funds from brands.

Source: CNN

Consumer Buying Behavior Post Vaccine:

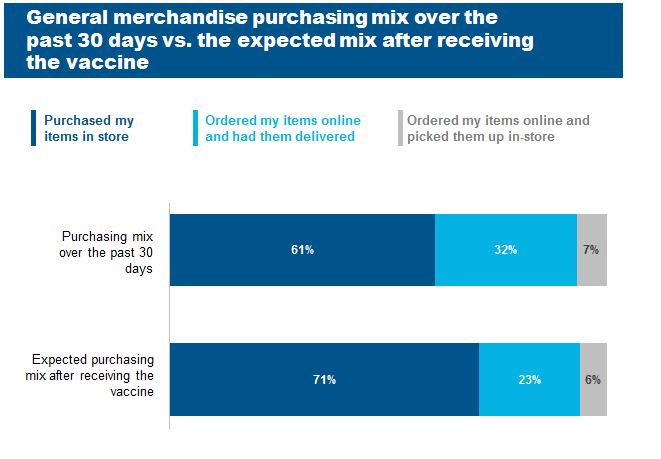

39% of consumers indicated they made the majority of their general merchandising purchases online over the last 30 days, a relatively consistent rate throughout the pandemic. However, when asked what they expect this mix to look like after they receive a vaccine, the rate dropped to 23%, suggesting there are meaningful intentions to return to stores. This supports many eCommerce professionals’ expectations for a very strong 1Q21 (essentially at similar Y/Y growth rates as what they experienced in 2020), followed by a slowdown in the remainder of the year. While most still expect to grow, the hurdle for pent up demand from consumers looking to return to stores will present a challenge for high growth targets in ‘21.

Source: CRC Consumer Survey | January 5, 2021 | 626 respondents