Amazon Price Increases & Instacart Consumer Insights Portal

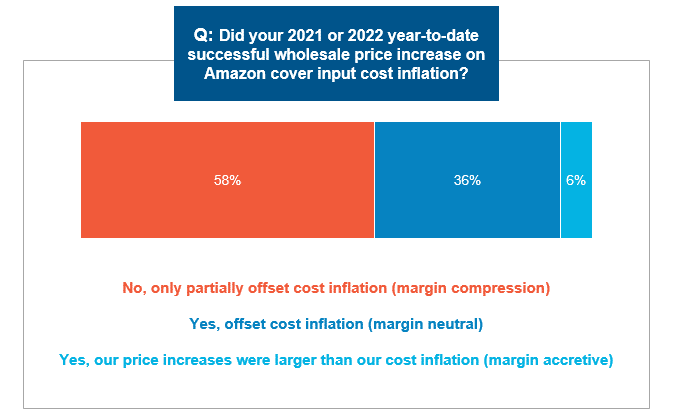

By Cleveland AdminPricing action does not look to be enough to fully offset input cost inflation for majority of brands:

In our latest benchmark we have found that Amazon price increases have not fully covered input cost inflation for brands, resulting in margin compression for 58% of brands surveyed. Given the significant increase in input costs combined with pushback from the retailer, it is unsurprising that only 6% of brands have found their price increases to be margin accretive. We anticipate seeing more pricing action throughout the rest of 2022 as vendors look to improve profitability.

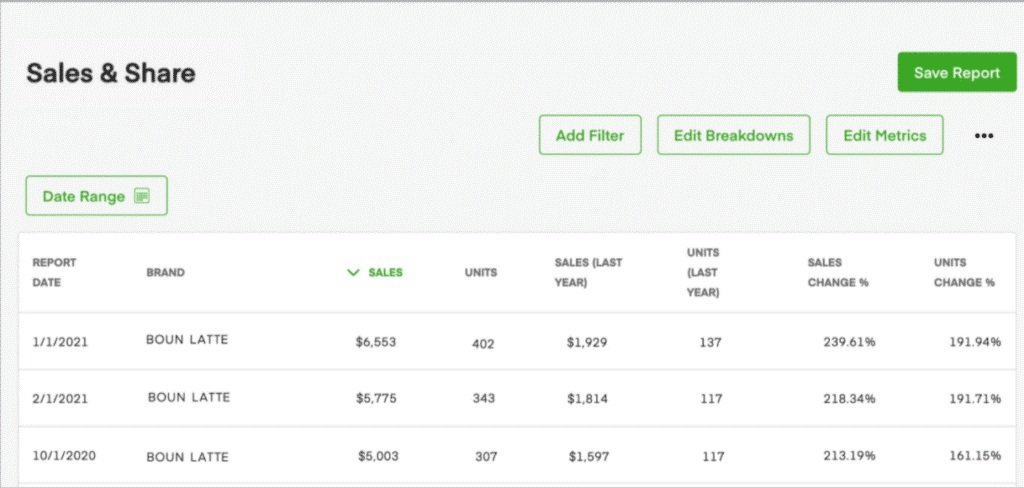

How to leverage the Instacart Customer Insights Portal:

Instacart launched its Customer Insights Portal in Fall 2021, allowing brands to access their sales data across over 600 retailers and 55,000 stores. The sales data includes total sales, market share, total units sold, and Y-Y metrics for sales and units, which can all be filtered down to a specific brand-line, region, category, and more. CRC’s Thought Leader Partner, Code3, suggests that once you have consistent access to the portal, brands should lean into market share as the best metric when they are planning and optimizing display campaigns or hero and storefront banners in order to see if campaigns were successful in increasing brand awareness. Additionally, comparing total sales to ad attributed sales can be helpful to see that ad spend is influencing the Instacart shopper.

Join CRC’s Instacart webinar in partnership with Code3 on Wednesday May 11th at 2 pm ET to learn more about how to capture the Instacart opportunity.

Click here to register.

87% of brands feel you need a VM or SAS resource to get a price increase through at Amazon:

According to our latest benchmark, 87% of brands report feeling that a Vendor Manager or SAS resource at Amazon is essential to getting a price increase through. Despite the importance of this relationship, more often in our research brands are dealing with Vendor Manager turnover at Amazon or a lack of urgency on Amazon’s end to have a 1×1 connection with a brand due to its size of business. Naturally, the biggest brands on Amazon appear to be having the easiest time getting price increases through, having multiple VMs on their account. Complete benchmark results will be published Monday May 2nd.