Amazon’s Future, Government Counterfeit Recommendations, Amazon Earnings

By Cleveland AdminIn our recent eCommerce Forecasts report we looked into Amazon over the next several years and saw several key changes occurring for the eTailer. The most notable is likely the continued shift towards 3P sales, which, as we noted previously, will likely account for nearly 70% of GMV in 2024. We also see significant growth likely in the company’s “Other” segment, which is expected to come from continued growth in advertising revenue which we predict will likely reach $50B+ in sales by 2024 (for reference, Facebook will likely have ~$70B in advertising sales in 2019). Our current estimates have physical stores continuing to be a smaller portion of Amazon’s revenue. However if the eTailer makes a major push with Amazon Go or new grocery locations, this could prove pessimistic. Our full estimates can be found in attached excel file.

Department of Homeland Security Looks to Combat Counterfeiting

The US Department of Homeland Security recently released a 54 page report to the President focused on combating international trafficking in counterfeit and pirated goods. The report highlights the growth in counterfeiting activity and presents a number of recommendations for both the US government and eCommerce marketplaces. Counterfeiting has become an increasingly large problem on Amazon’s 3P marketplace as international sellers are able to easily sell counterfeit goods to unaware consumers. Amazon has introduced a number of programs aimed at fighting this problem, most recently Project Zero, however brands continue to highlight counterfeits as a problem on Amazon’s platform.

Amazon Earnings

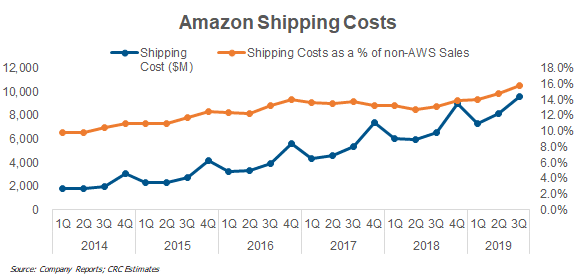

Amazon reported its quarterly earnings, which we watched closely. Our work has indicated Amazon has continued its focus on growth in a number of areas, mostly notably in the expansion of faster shipping options for consumers including overnight Prime delivery and free Amazon Fresh grocery delivery which offers shipping as fast as two hours in some geographies. This has required significant investment into the eTailer’s supply chain, with shipping costs growing ~$3 billion in 3Q19 vs 3Q18, including close to a billion dollars tied to next day deliver. Amazon also noted that they expect 4Q to see an even larger impact for next day delivery, estimating an incremental spend of $1.5 billion during the quarter.