Back-to-School Insights & Instacart Updates

By Cleveland AdminAmazon, Target, Dollar Stores, & Walmart are viewed as winners this BTS season:

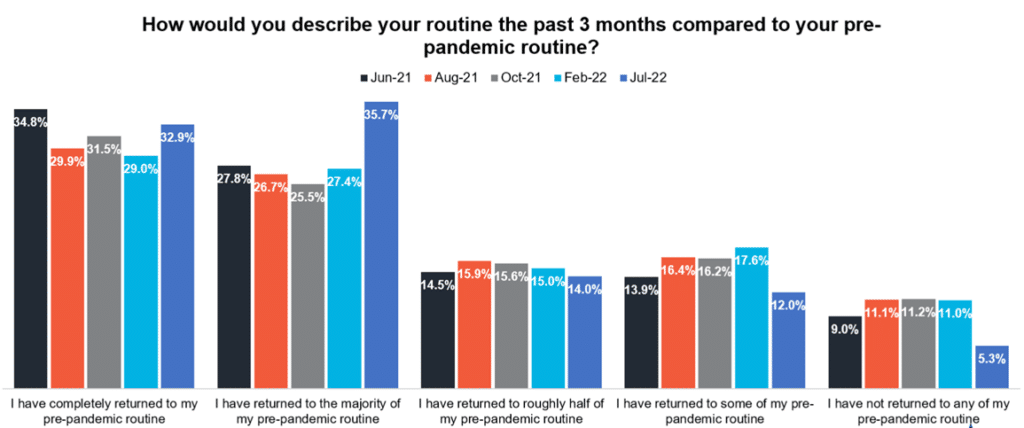

This week CRC’s Traditional Retail Council hosted a webinar on current back-to-school trends as we head into the heavy promotional season. The team unpacked the most important macro/consumer trends, back-to-school forecasts, early holiday projections, and key focus areas for suppliers. At a high level, consumers remain anxious heading into 2H22, and we see consumer and small business confidence levels at or below 2008 levels suggesting we pay see a pullback in spend over the next 6 months. Additionally, inflation is not showing signs of slowing, supply chain issues are still in effect, and many retailers are still battling through inventory challenges. Brands are forecasting a low-single to mid-single digit lift during the BTS season. We see spending on core categories may still perform well, but expect a shift away from discretionary categories. Looking to ecommerce in particular, we continue to see shoppers head into stores (~69% of consumers have returned to their pre-pandemic routine). Amazon’s Prime Days this past week will likely set the tone for the rest of this promotional season, as retailer and brands likely continue to pull forward holiday demand even more so than last year.

Brands are looking for 10-15% growth on Instacart in 2022 – consumer health key variable for 2H22:

In our most recent Instacart update we’ve found that in 2022 year-to-date trends appear mixed with variability depending on a brand’s competition and category dynamics. Overall, trends seemed to improved in 2Q22 following a slower than anticipated start in January and February for most brands. We estimate Y-Y growth on Instacart has been running in the 10-15% range over the last few months following growth closer to high-single digits to start the year. This sequential improvement looks to be due to a combination of easier comparisons, better supply chain situation, and some topline benefit from increased pricing this year (although weighing on units). Looking to the rest of 2022, brands are anticipating fairly steady growth with estimates in the 10-15% range for the full-year (in-line with where 2Q22 trended). Two potential headwinds for this outlook are 1) a consumer pullback in spend due to macroeconomic factors and 2) increasing last-mile provider competition. For brands, managing sales targets and expectations appropriately will be key as Instacart’s forecasts can be quite aggressive – many times we hear 2-3x what’s realistic. Further, be prepared for a more competitive 2H22 as brands look to offset any consumer pullback given the discretionary nature of Instacart and premium prices.

Find creative ways to manage the lack of retailer-specific Instacart sales data disclosed:

In order to secure incremental budget and potentially trade/customer spend, brands need to know what retailer account Instacart sales are coming through. Although Instacart does not report this our directly, some vendors are finding creative ways to solve for this lack of transparency. A few methods are outlined in our latest Instacart update. For example, ask for Retailer Loyalty Program Data. Aside from the complex process of creating unique UPCs per retailer, one way to parse out retailer sales data is to consider looking at loyalty programs where shoppers must submit their receipt for points (i.e. a Kroger loyalty program) – through receipts, the Kroger team (for example) can know which of their eCommerce sales came from Instacart. Alternatively, in small pockets, brands have mentioned that a couple of retailers have given them Instacart sales data directly in 2022. Aggregating proxies like receipt data or loyalty program data can be directionally helpful to secure additional funds within your organization.