Digital Activation; Changes to Amazon Seller Profiles; China’s Shopping Holidays

By Cleveland AdminOur most recent report on commerce marketing highlighted steady, but perhaps, slow progress from Amazon’s key omnichannel rivals. In our research, brands are continuing to look for more advanced analytics and activation options across Walmart, Target, and Kroger in particular. While these retailers are eager to build a robust advertising business to offset the growing costs from fulfilling more items online, eCommerce leaders are suggesting they need more insight on the true ROI of these platforms in order to win internal support and budgets.

Source: Amazon.com

Changes to Amazon Seller Profiles:

Effective September 1, 2020, Amazon will display the business name and address of U.S. sellers on their Amazon.com seller profile. The eTailer is making this change across Amazon stores in Europe, Japan, and Mexico. This announcement comes on the heels of the eTailer creating a Counterfeit Crimes Unit in an attempt to limit fraudulent third-party activity on the site. This change brings Amazon one step closer to eliminating counterfeits on its third-party marketplace, an important part in building trust in both customers, and branded manufacturers selling on the platform.

Source: aboutamazon.com

China’s Shopping Holidays:

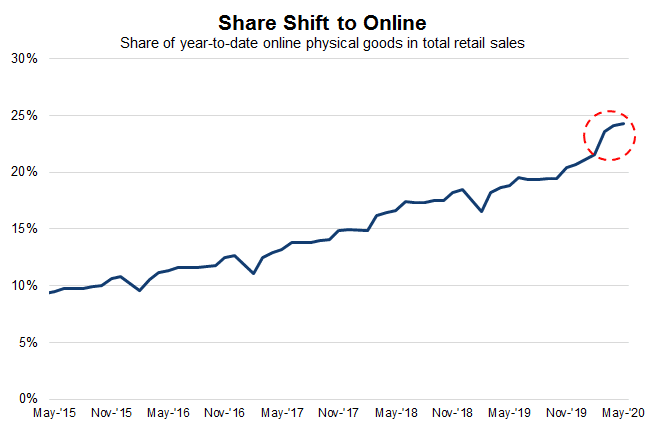

JD.com and Alibaba have become masters at creating major shopping holidays in China. During the most recent mid-year online shopping festival (618 or June 18th festival), Alibaba and JD.com, the two largest eCommerce retailers in China, hit record sales of $136.5 billion, suggesting both eCommerce and consumer demand in the country remains strong. Further, eCommerce now accounts for 24% of total retail sales in the country compared to 21% at the end of 2019 (and 12% in the US).