Direct Import Program; Walmart+ Launch; Increasing Budget for Amazon Paid Search

By Cleveland AdminWe estimate Amazon’s GMV growth rate nearly doubled in 2Q20 as pandemic-driven buying behavior increasingly shifted online. We expect this trend to continue, forecasting 37% and 40% growth in 3Q and 4Q respectively. With massive growth comes fulfillment challenges and ordering and supply chain initiatives are increasingly being discussed in the manufacturer community as a result. One example is the recently launched Direct Import self-service tool. If a vendor code meets certain sales and profitability thresholds, it can be submitted through the self-service tool instead of working with the VM, effectively getting POs from Amazon faster.

Our research suggests Direct Import is best for well-established products where forecasting is more accurate, as we have heard of problems resulting in overstocks or out of stocks depending on performance when it comes to new products. If a certain ASIN is domestic and Direct Import but is not experiencing the preferred percentage split, brands might try to remove the offer so that they don’t want Amazon to order on, even if Amazon may not prefer this approach.

Source: Grant Hindsley/AFP via Getty Images

Walmart’s Launch of Walmart+:

This week Walmart had a soft-launch of its annual subscription-based membership called Walmart+, with plans to go nationwide on September 15th. Membership costs $98 per year (compared to $119 for Prime membership and $99 for an annual Instacart membership) and includes unlimited free delivery for orders over $35, discounts on gasoline, and access to its Scan & Go technology allowing customers to pay on the spot and avoid checkout lines while in stores.

Will it be successful? That depends on the comparison.

Our research suggests 56% of current Walmart online shoppers are Prime members (a program that offers more benefits than Walmart+) and the other 44% have decided for years that a Prime-like program isn’t for them. Further, Amazon is reaching 90% of Walmart.com shoppers already (vs. Walmart only reaching 60% of Amazon shoppers). This shows that Amazon has a massive share of Walmart.com shoppers within its Prime program and the ability to market Prime benefits to a much larger group compared to Walmart. Walmart+ is then left with a small market of its most loyal consumers that are not Prime members. These loyal consumers desire a Prime-like program and do not already shop on Amazon. Thus, we believe the strategy behind Walmart+ is limiting the rapid growth of Instacart and Shipt, making the recent partnership between Walmart and Instacart all the more interesting to follow in the year ahead.

Source: Walmart

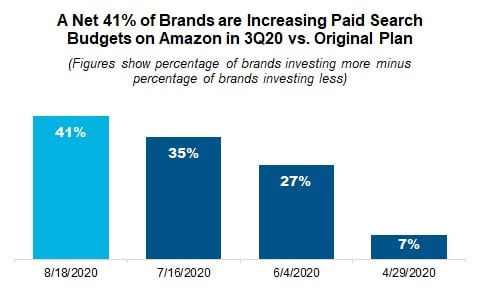

Increasing Budgets for Paid Search on Amazon:

Paid search continues to see the greatest increase in spend on Amazon during the pandemic, particularly for the food and consumables categories with the exception of hardlines. Manufacturers that fund Amazon paid search as a percentage of sales appear to have a natural advantage over their fixed-budget peers, as they have been able to increase spending more quickly. Only a minority of manufacturers (45%) that have fixed budgets have increased their amount of investment on the site, putting them at a disadvantage to participate in the growth of the channel during the pandemic. Certainly, any budgets set pre-pandemic should be re-evaluated immediately and aligned with the step-function increase seen on Amazon and other digital channels as well.

Source: CRC COVID-19 Benchmark, April 29, June 4, July 16, and August 18, 2020, n varies (55 to 91)

Note: The question posed in the 4/29 and 6/4 studies centered on changes to 2Q strategy, while the 7/16 and 8/18 question asked about 3Q.