eComm Logistics, Target Loyalty, Amazon Sales

By Cleveland AdminLogistics Remains a Focus for eTailers as Amazon Continues to Raise the Bar

Amazon’s announcement last quarter that Prime Shipping would move to overnight delivery from the prior two-day, appeared to drive increased sales for Amazon and allow the eTailer to take share. In response, other eTailers looked to increase investments as a way to compete with this improved offering from Amazon. One notable is example is Shopify’s recent introduction of its Shopify Fullfillment Network offering, whereby retailers and brands can use its network of owned and rented fulfillment centers to enable faster shipping. Brands that have struggled to find a way to fulfill an each to the home in a quick, economical manner may want to evaluate this new program. Several other eTailers talked about their delivery offerings as well, including Wayfair (Castlegate) and Etsy (focusing more on offering free shipping).

Target Rolling Out “Target Circle” Loyalty Program Nationwide

This week Target announced that they were expanding their new Target Circle loyalty program nationwide on October 6th. This loyalty program appears similar in many ways to Amazon’s Prime and Amazon Smile offerings, providing perks such as early access to special sales and allowing consumers to direct charitable donations to the organization of their choice. The program also offers a 1% discount on all Target purchases. Target noted that more than two million consumers have already enrolled in the program during early tests in six key markets, which is likely to expand as the program becomes available nationwide. We view these types of programs as likely to continue to expand as retailers look to retain consumers in an increasingly competitive online environment.

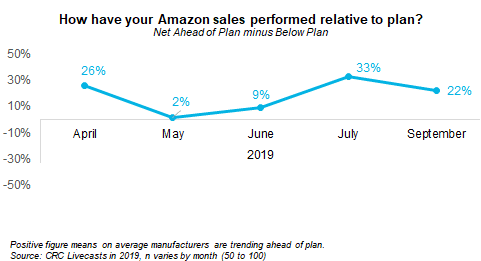

On average, positive performance has continued in 3Q19 with manufacturers’ Amazon business performing ahead of plan

For 3Q in particular, a net 22% of manufacturers are seeing sales track ahead of plan. Our latest consumer research suggests strong growth in Prime membership adoption, which we believe is helping fuel sales. In addition, Amazon has focused more on growing revenue this year versus its profit focus last year. This has included adding back items to 1P assortment that it previously delisted, helping improve assortment and therefore the consumer experience. In addition, the expansion of one-day delivery to over 90% of the US with more than 10 million available items is believed to be a key driver to better than expected sales.