eCommerce Highlights from Retailers’ 2Q21 Results

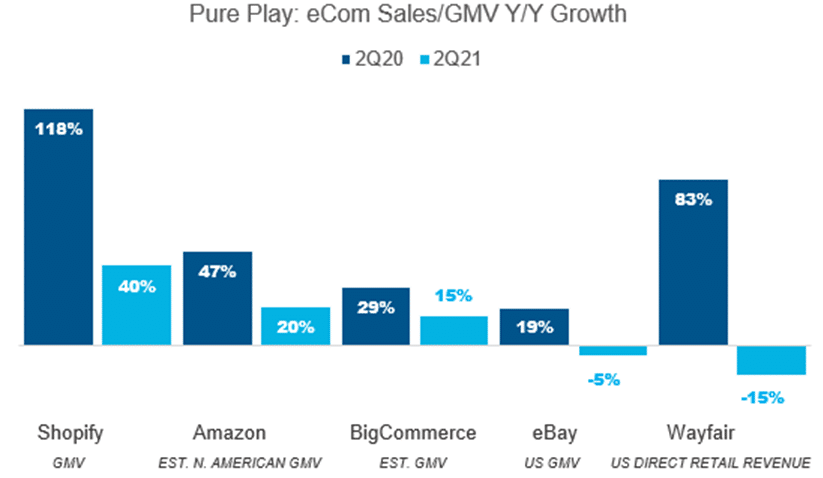

By Cleveland AdminShopify was the clear winner this quarter with 40% growth on top of 118% in 2020, driven by sustained strength in GMV and contributions from their POS offering and social commerce partnerships. Management noted that omnichannel opportunities will continue to remain a top priority, such as retail POS, social partnerships, and the Shop App.

Amazon grew N. American GMV an estimated 20% this quarter, impressive relative to its pure play peers albeit a deceleration, with management pointing to consumers shifting spending back towards stores and/or away from shopping altogether. The 3P business continues to grow faster than the 1P business, driven in part by a strong Prime Day for 3P sellers in particular. 3P accounted for 56% of total paid units in 2Q, up from 53% in the comparable 2Q20.

BigCommerce saw strong momentum through the quarter with total revenue up 35% and our estimated GMV up in the mid-teens range. BigCommerce recently announced the acquisition of the data feed management platform, Feedonomics, which is currently being used by nearly 30% of the top 1,000 internet retailers and will give BigCommerce merchants access to 100+ global marketplace and advertising channels, driving further brand visibility, order volume and conversion.

eBay saw a decline this quarter (down 5%) but is lacking the more positive outlook we heard from Wayfair (below), having transferred its Classifieds business to Adevinta and selling off their shares, on top of selling eBay’s Korean business to Emart.

Wayfair saw a 15% decline in eCommerce growth this quarter on top of 83% growth last year, with our research having pointed to softening underlying demand and inventory out-of-stocks. However, management provided positive commentary on active customer growth (nearly 20% growth Y/Y) as well as customer loyalty, with repeat customers placing 76% of total orders in 2Q21 compared to 67% in 2Q20.

Source: Company filings and management calls, FactSet, CRC estimates

Mass Omnichannel 2Q21 Highlights:

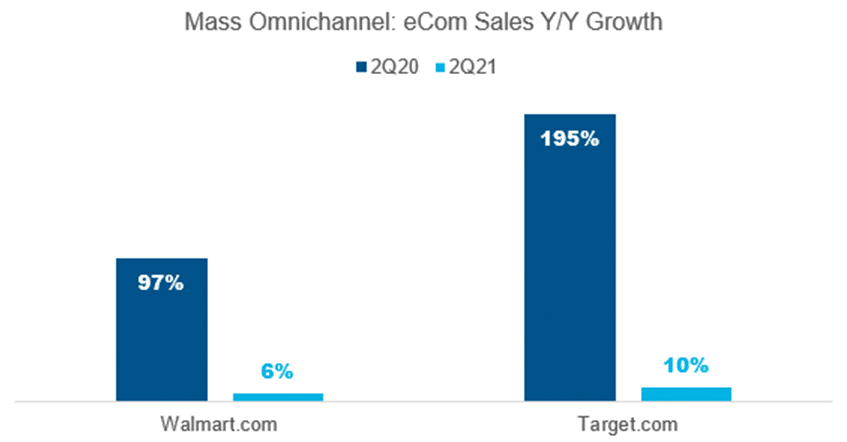

This quarter, mass omnichannel retailers saw a reversion to off-line trends with Walmart.com and Target.com posting mid-single / low-double digit growth in comparison to high-double and solid triple digit growth in 2Q20.

On the Walmart 2Q21 earnings call, management emphasized that customers are returning to stores, traffic is accelerating, and the company is continuing to see strong market share gains in grocery. Despite the moderation in eCommerce growth rates, the Walmart Connect (WMC) business nearly doubled Y/Y, and active advertisers on WMC are up over 170%, a strong needle mover in the advertising space. Walmart also mentioned fulfillment services for sellers are continuing to scale, and they are on track to hit double digit GMV penetration by year-end.

Earlier this week, Walmart also announced the launch of their delivery as a service business, GoLocal, in which Walmart will utilize the capabilities supporting their network of 4,700+ stores to help other businesses and their digital transformations.

Target.com saw slightly better growth this quarter (10% vs. 6% for Walmart.com). Some key callouts were that their same-day services (Order Pickup, Drive Up and Shipt) grew 55% on top of 275% last year, now accounting for more than half of Target.com’s sales. Additionally, more than 95% of Target’s 2Q21 sales were fulfilled by its stores, a heavy lean into the dynamic omnichannel world. eCommerce accounted for 17% of Target’s total sales this quarter, roughly in line with the 18% Target reported in 2020 (and compared to 9% in 2019), demonstrating Target has done a great job maintaining the digital share it picked up throughout the pandemic.

Source: Company filings and management calls, FactSet, CRC estimates

Home Improvement Omnichannel 2Q21 Highlights:

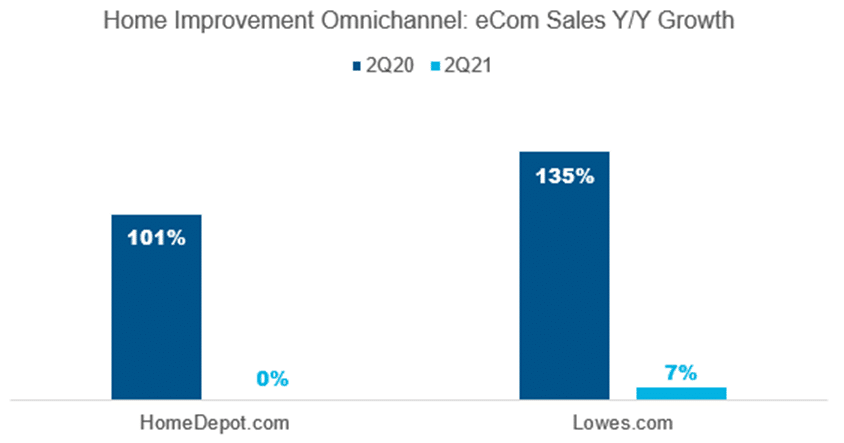

Online sales for 2Q21 were flat Y/Y at Home Depot and up 7% Y/Y at Lowe’s. Similar to many of the other pure plays and omnichannel retailers that recently reported, maintaining flat to low growth is noteworthy this quarter, going against previous peak growth rates in 2Q20 (100% at Home Depot and 135% at Lowe’s). While Home Depot has historically been the digital winner vs. Lowe’s in both online penetration and sales, the change in consumer behavior (driven by COVID-19) along with Lowe’s improvements and investments have helped Lowe’s narrow the gap; Lowe’s online business is now roughly half the size of Home Depot’s, compared to less than one third at the start of 2020.

Source: Company filings and management calls, FactSet, CRC estimates