eCommerce Forecasts, P&L Credit for Amazon Advertising, Freight Update

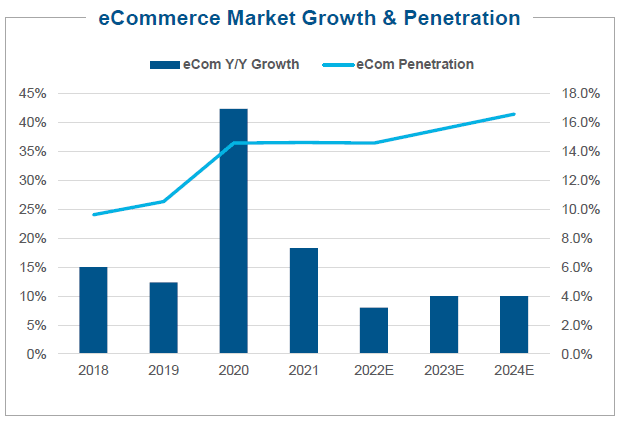

By Cleveland AdmineCom penetration likely returning to pre-COVID growth rates; estimated ~1 pt incremental improvement each year:

Last week in our mid-year forecast report, we published our estimations for 2022 to 2024. Overall, it appears that since our last forecast report in January, eCommerce penetration has come down as shoppers return to stores. The idea of COVID-19 pulling forward years worth of eCommerce growth no longer seems to be the case. We estimate that the eCommerce end market will grow in the high-single digit range in 2022.

See below for a key highlight for each channel:

- Amazon: Compared to online peers, Amazon seems better positioned given their capacity to handle more inventory, push for selection, and promotional activity planned for the back half of the year. We estimate Amazon’s North America GMV to grow in the high-single-digit range in 2022.

- Omnichannel – mass: Omnichannel players are likely seeing a moderation in their online businesses as consumers shop more in stores (margin tailwind). Accordingly, we are estimating Walmart to grow its eCommerce sales this year by 9% compared to Target at 13%. By 2024 we anticipate eCommerce penetration to be 15% for Walmart and 25% for Target

- Omnichannel – home improvement: In 2022 we estimate Home Depot and Lowe’s will grow their eCommerce Sales by 9% and 4%, respectively. In terms of penetration, Lowe’s continues to be behind Home Depot given Home Depot’s multi-year head start. By 2024 we estimate Lowe’s and Home Depot’s eCommerce penetration to be around 15%.

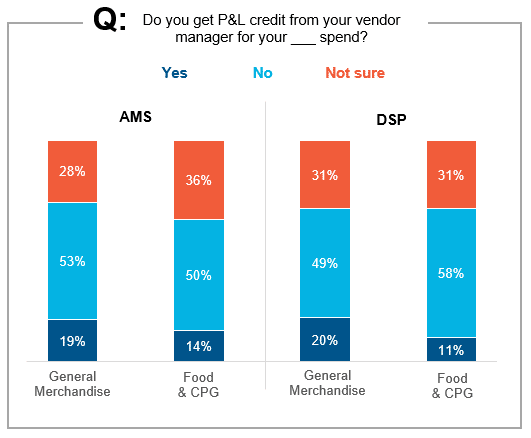

Some select vendors get P&L credit for their Amazon Advertising spend:

Feedback from our advertising benchmark suggests that some brands receive P&L credit from their vendor manager for their AMS/Console or DSP investments. The results indicate this practice seems slightly more common amongst General Merchandise brands compared to Food & CPG peers. In total, a net 18% more General Merchandise brands reported receiving P&L credit for AMS in 2022 compared to 2021 (net 27% more General Merchandise brands for DSP).

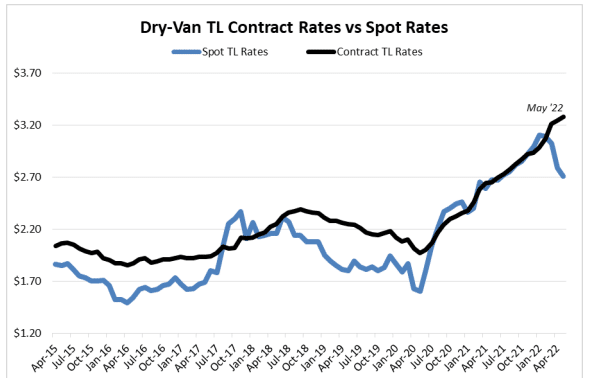

Downward trend in spot market pricing driven by slowing consumer demand:

Spot Truckload rates have moderated and are now cheaper than contract rates in May (including fuel), reflecting softer organic demand and more available capacity. Our work indicates truck pricing is near peak, with brokers preparing to lower contract rates likely 5-10% lower in 2H22 vs current, while asset-based carriers maintain pricing (2021 rates were +10-15%). This looks to be driven by slowing consumer demand (while industrial piece of economy remains strong).