eCommerce Growth, Pull Back in Ad Spend & Consumer Spending

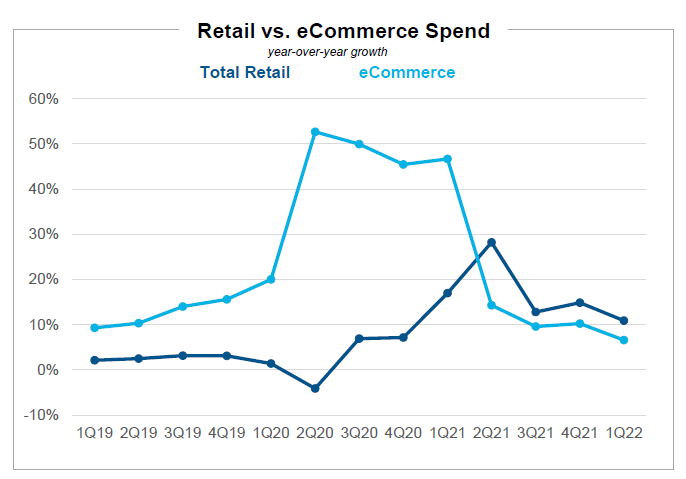

By Cleveland AdmineCommerce growth moderating with digital penetration normalizing; retailers continue to make omnichannel investments:

In our latest slide deck we take a look at 1Q22 results from some of the largest retailers and online marketplaces. Within these results we see online sales in the mid-single digit range with eCommerce penetration at 14.3% (peaked at 16.4% in 2Q20) highlighting shoppers return to in-store. Even with total retail sales slowing and a more challenging margin/working capital environment, retailers remain focused on their omnichannel investments (supply chain, tech, store remodels, etc.) as well as continuing to pursue margin favorable initiatives such as their retail media networks.

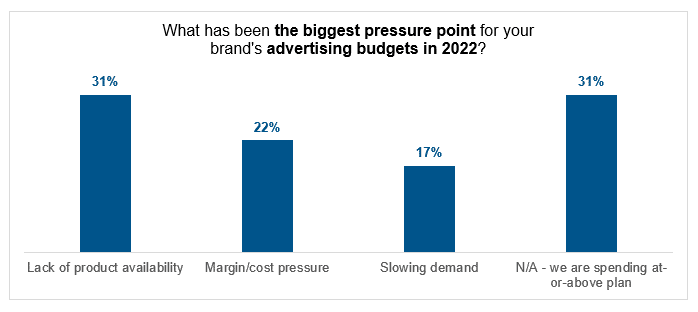

2022 digital advertising spend estimate reduced from +15% to +10-15%:

Last week CRC’s digital advertising research team hosted a webinar highlighting their latest research on the macro advertising environment, search and Google insights, and perspective across the major social media platforms. The team shared the clear slowing that took place in March and April as brands/agencies pulled back on advertising spend due to inflationary pressures, slowing demand, lack of product availability, and a less certain macroeconomic backdrop. Interestingly, brands cited product availability as the number 1 pressure point for ad budgets so far this year. Weakness in ad spend was called out in goods/product categories compared to service/experience segments, which showed relative strength.

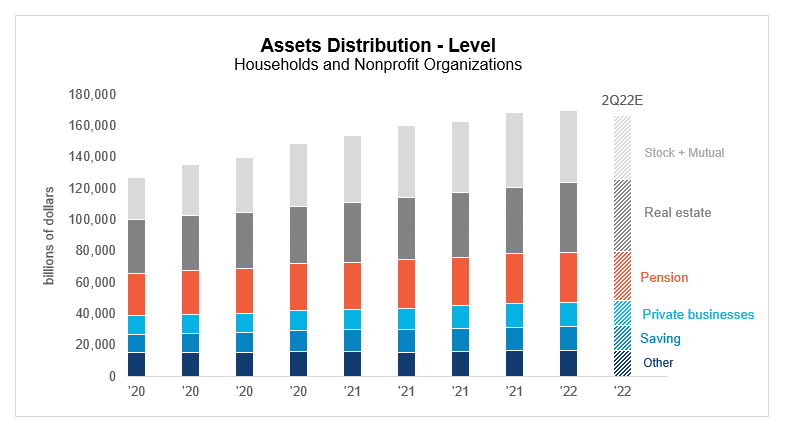

Stock market crash may reduce U.S. consumer spending:

The recent stock market drop will likely negatively impact consumer spending in the near-term by shrinking wealth and lowering consumer confidence. As a leading/coincident economic indicator, the stock market often experiences volatilities before and during an economic recession, reflecting the weakness in economic fundamentals. During these periods, the growth of consumer spending decelerates or declines. Since the top 10% owns 90% of the stock assets, the wealthiest families may feel the most direct impact of the stock market crash. We may see more softness in luxury spending such as jewelry, boats, and RVs than in non-discretionary spending. Though the lower-income group owns only 10% of the stock assets, the financial market turbulence could impact spending by lowering consumer confidence in the economic outlook. Historically, the annual growth of nominal personal consumption has slowed following a stock market crash, even in absence of a recession afterward.