Freight Savings; Alibaba in the US; Amazon Segment Growth

By Cleveland AdminShippers Seeing Opportunity for Freight Savings

Our research into the transportation space has indicated that Truckload (TL) rates are trending down 5-10% in recent bids (as compared to 5-10% increases a year ago), providing an opportunity for manufacturers to mitigate cost pressures across the rest of the business (tariffs, raw materials, etc.). These rate declines appear driven by weaker than expected volumes (tied to elevated inventories and minimal organic growth), leading to excess capacity and aggressive bidding by brokers and carriers to capture share. We are also seeing Intermodal rates move lower, currently trending flattish with increased likelihood of low-single digit declines year/year.

Alibaba entering the US B2B eCommerce Market

This week Alibaba announced that it was launching a digital platform in the US to connect sellers to vendors, services, and international buyers with a focus on the B2B market. Key partners include Office Depot and food supplier Robinson Fresh. The B2B market is significantly larger than the consumer eCommerce market, however Amazon and other eTailers have found it difficult to gain significant traction in this market, so we will be closely monitoring Alibaba’s progress.

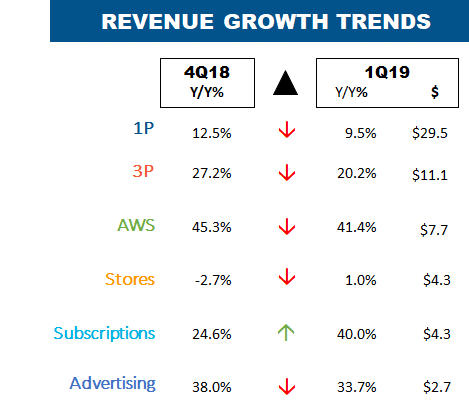

Amazon Reports 2Q Results Tonight – 1Q showed strong 3P and Advertising Growth

Amazon will announce it’s 2Q earnings results this evening, and we expect similar themes to what was discussed in the eTailer’s 1Q results in April. Last quarter, Amazon saw significant growth in its 3P, Subscriptions (Prime), and Other (Advertising) businesses, while 1P and Physical Stores saw slower growth. Also interesting will be any discussion on the impact of Prime overnight delivery and the impact of Prime Day. We will have a detailed report tomorrow morning.