Holiday 2021: Supply Chain Pressures, Rising Demand and Price Increases

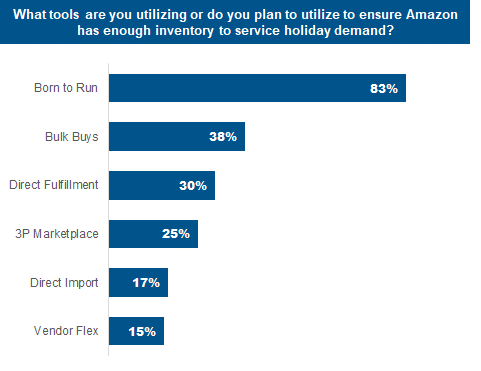

By Cleveland AdminOur recent Consumer Holiday Pulse Survey showed 43% of consumers have already started holiday shopping. A net 57% of those shoppers reported that they started earlier this year vs. last, largely due to supply chain concerns. Most brands are experiencing severe supply chain constraints heading into this holiday season including issues with manufacturing, importing, fulfillment centers and more. To ensure inventory is where it needs to be in order to meet consumer demand, brands have started to pull a variety of supply chain levers. In our recent Amazon Supplier Benchmark, 83% of brands reported leaning into Born to Run, with another 38% using Bulk Buys. These were both cited as ways to supplement Amazon’s algorithmic ordering that may be holding back due to pressures on Amazon’s own supply chain. Another attractive option is to bypass Amazon’s fulfillment network altogether, with 30% of brands leveraging Direct Fufillment (i.e. drop ship) and 15% using Vendor Flex (much higher for Food & CPG brands).

Source: CRC Amazon Supplier Benchmark, October 2021, n=98, 38 Food & Consumables respondents and 59 General Merchandise respondents

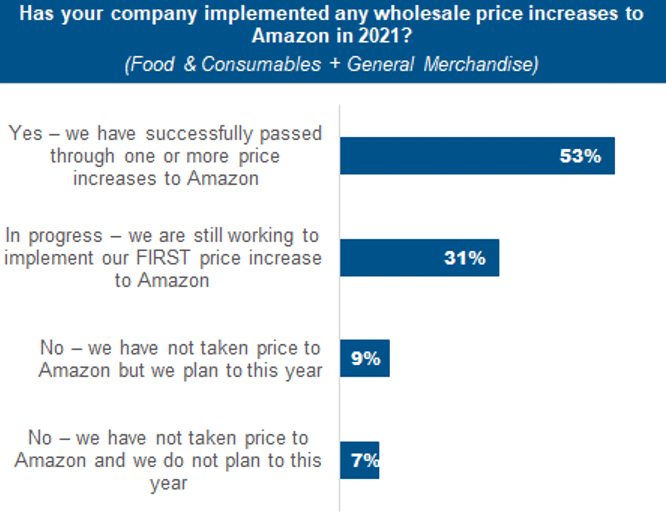

93% of brands will go to Amazon with price increases this year: Our Amazon Supplier Benchmark and broader research suggests price increases are inevitable for almost all brands, as 93% of brands surveyed have either already passed price to Amazon, are working through a price increase now, or plan to pass price at some point this year. This increased from the 85% of suppliers that cited price increases in our July benchmark. The price increases average out to 5.5%-6.5% per increase, although our research suggests this will not be enough to offset the inflationary pressures brands are facing; 61% of those that have already passed price or are currently working through a price increase are planning to pass more price increases through the end of 2021 or in 2022, which has nearly doubled from our July benchmark.

Source: CRC Amazon Supplier Benchmark, October 2021, n=98, 38 Food & Consumables respondents and 59 General Merchandise respondents

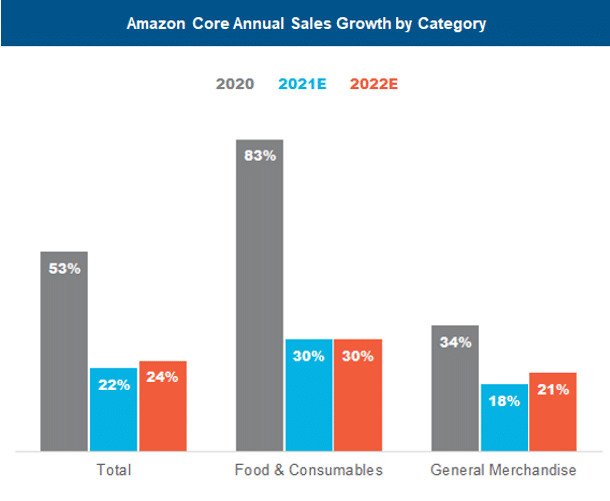

Brands are forecasting 24% growth with Amazon in 2022; Roughly in line with 2021 growth rates: According to our benchmark, brands’ growth forecasts for the core Amazon.com platform are averaging out to 22% for 2021 and 24% for 2022. This represents a slight step-down compared to our July benchmark on top of a meaningful step-down vs. our January benchmark. The pressures on the supply chain and ever-changing levels of consumer demand are unquetionably creating challenges for accurate forecasting. At the macro category level, Food & Consumables brands are forecasting ~30% growth for 2021 & 2022 compared to ~20% for General Merchandise brands.

CRC Amazon Supplier Benchmark, October 2021, n=98, 38 Food & Consumables respondents and 59 General Merchandise respondents