Overlap, Stores, Growth Outlook

By Cleveland AdminAmazon Shoppers Increasingly Considering Walmart.com

Our recent consumer study on Amazon.com and Walmart.com shoppers indicated that 90% of Walmart.com shoppers also purchase on Amazon, and 60% of Amazon shoppers buy on Walmart.com. This means that similar strategies can work for both cohorts. Brands can utilize what they’ve learned on Amazon especially when it comes to product content and attributes to enhance Walmart.com product pages, in addition to consistent assortment. Because there is such a large overlap between Amazon and Walmart.com shoppers, both Walmart.com and Amazon ad strategies can be used in concert with one another. While our consumer study findings suggest that Amazon is used by both cohorts along the entire path to purchase, it is more likely to be used for discovery and product research, and consumers are going on Walmart.com when they are ready to buy. Thus, in general, awareness building advertisements should lean towards Amazon versus Walmart.

Amazon Continues to Expand Physical Store Footprint, Including Grocery Store Chain

The WSJ reported that Amazon is planning on opening a chain of grocery stores across the US, with early locations in Los Angeles, Chicago, and Philadelphia. These stores are expected to be different in format from Amazon’s existing Whole Foods, Amazon Go, and Amazon 4-Star brick and mortar locations, and could open as early as late this year in Los Angeles. Amazon also continues to expand it’s 4-star format opening a new location in Massachusetts this week, and is considering licensing it’s Amazon Go technology to movie theaters and airport convenience stores. It’s multi-pronged approached is especially important in the grocery industry where there has yet to emerge one winning digital model.

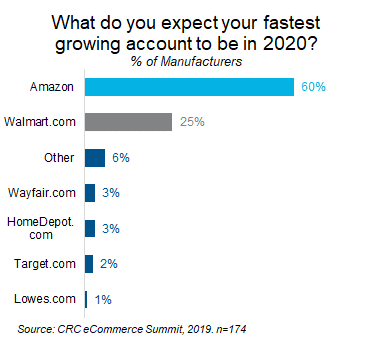

Amazon and Walmart.com Expected to Grow Fastest in 2020

Feedback at our eCommerce Summit indicated that the vast majority of branded manufacturers expect Amazon.com or Walmart.com to be their fastest growing account in 2020. Walmart.com’s growth appears tied largely to continued growth in the Omnichannel retailer’s Online Grocery offering.