Return to “Normal”; Antitrust Charge in Europe; Income Breakdown

By Cleveland AdminWhile the COVID-19 crisis will leave us with a “new normal,” we have been gauging when consumers expect to resume behaviors that were considered commonplace prior to the crisis, such as going out to eat and shopping at an indoor mall. In comparing the results from our study last month, it appears that consumer outlook has worsened. For example, only 35% of respondents expect to “return to normal” by September compared to 53% previously. Additionally, respondents living in regions where shelter in place orders have been relaxed are exhibiting marginally more optimistic plans compared to those where shelter in place orders remain, although a high degree of caution remains for them. Based on these results, planning should incorporate a very gradual shift back towards normal that may extend into 2021.

Antitrust Charges in Europe

Amazon, much like its technology peers Google and Facebook, has continued to face antitrust concerns for multiple years now across global regions, stemming from dominance in their respective areas, privacy concerns, and content concerns. According to the Wall Street Journal, the European Union is planning to make antitrust charges against Amazon within the next two weeks. The core charge relates to Amazon running the marketplace and selling its own products. The EU alleges this gives Amazon an unfair advantage as it can use data from third-party sellers for its own benefit, such as developing private label offerings or securing competing products for cheaper elsewhere.

Income Breakdown:

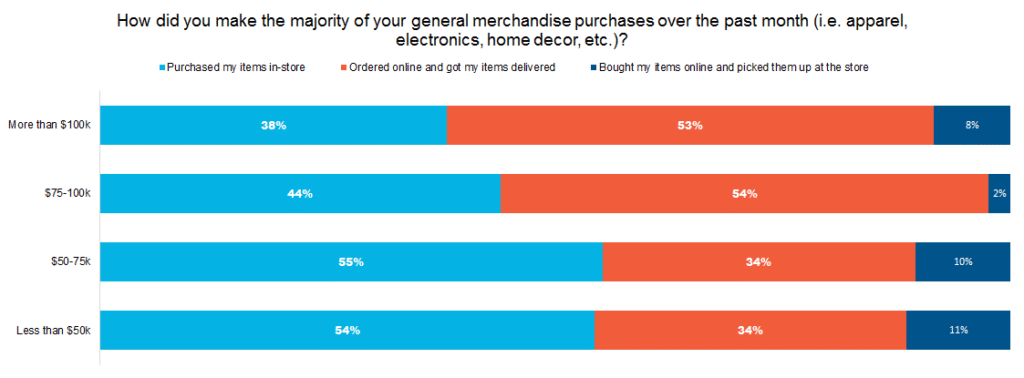

Our latest consumer study highlighted resilience in online shopping within general merchandise categories. According to the data, consumers in above-average income segments are the largest adopters for ordering online and having items delivered to the home. Average and below-average income shoppers are more likely to be shopping inside of stores and/or using click and collect models. The (very) early results on comparing consumers in more open vs. more restricted regions suggests shoppers using click and collect are more likely to revert back to stores compared to those using delivery. Taken together, this suggests brands focused on upper income consumers may likely see a greater stickiness to online shopping as we progress out of the crisis (and vice versa).