Social Commerce, Free Fresh, Amazon Growth

By Cleveland AdminSocial’s Not Just for Inspiration

Our research indicates that the usage of social media has increased significantly in eCommerce with 42% of consumers now using social media “almost always” or “often” in their research process, up from 32% last year. This is consistent with growth in overall social media usage with 58% of consumers signing into their apps multiple times a day (up from 49% last year) and using these platforms for everything from inspiration (83% of consumers), to information gathering (81%), news (75%), and entertainment (92%). Social media is also becoming increasingly influential in purchase decisions, with 70% of US consumers reporting they research or purchase a product because of something they’ve seen on social media (up from 53% last year).

Amazon Ends Fresh Fees

Amazon announced this week that it was making AmazonFresh a free benefit for Prime members, ending the prior $14.99/month fee that it had charged for the service. This comes as Amazon continues to expand availability of UltraFast Fresh to more cities, in an effort to gain share in the historically brick and mortar dominated category. The monthly fee for Amazon’s grocery delivery has been a major headwind to consumer adoption of the service, so we anticipate that this could improve adoption of the service significantly, especially if Amazon puts more marketing muscle behind the initiative. This could also put pressure on Walmart’s successful online grocery pickup, as our research has indicated that all else equal, consumers would prefer grocery delivery over grocery pickup.

One-Day Delivery Helps Fuel Growth

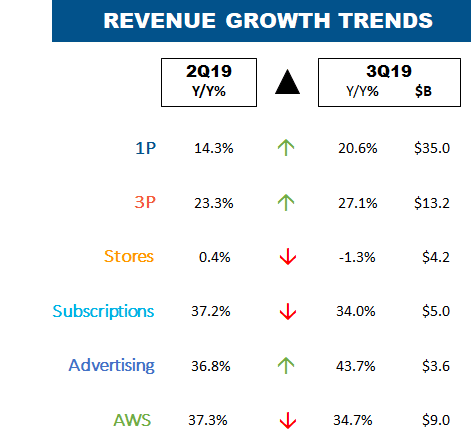

Amazon’s 3Q19 results demonstrated its focus on growing revenue despite the negative impact to margins. Its retail business, including both 1P and 3P, experienced accelerating growth rates in the quarter. In addition, both N. America and International retail business segments demonstrated a faster pace of growth than what we saw from Amazon in the first half of the year.

The primary driver to this strength has been its nationwide roll-out of one-day delivery, a program that Amazon indicated is driving incremental purchases from its customers. The company appeared to execute one-day well during Prime Day, giving the retailer confidence it can manage peak demand come this holiday season. The investment is meaningful though, with Amazon indicating they’ll spend an incremental $1.5B to execute one-day delivery in 4Q alone. This increased investment is going mostly towards increased transportation costs, in addition to reconfiguring much of the retailer’s FC operations, such as adding new shifts, new sort centers, and using forward deployment more, among other initiatives.

Just like in prior cycles, Amazon is demonstrating it is willing to invest if it means creating a meaningful benefit for customers. Amazon changed consumer behavior to expect two-day delivery in the past, and it is now rapidly working to move that expectation to one-day delivery. The expertise, capacity, and scale needed to make one-day work is making Amazon an even more formidable competitor to its rivals like Walmart, Target and Home Depot.