What Suppliers are Spending on Instacart, Walmart, and Amazon Advertising

By Cleveland AdminAfter meaningfully ramping up Instacart advertising investments in 2021, our research suggests suppliers are planning for much less growth in ad spend in 2022. While brands remain quite pleased with ROAS, many are experiencing challenges in securing incremental funding given the growing competition for advertising dollars and the inability to attribute the spend back to specific retailers as Instacart does not share retailer-level data. While spend remains focused on Featured Products (i.e. paid search), Instacart has rolled out more display and upper funnel advertising features in recent months that brands are either beginning to test or are hoping to test in 2022 if additional funding can be secured.

Brands looking to increase spend ~30% Y-Y in FY23 on Walmart Connect: Our latest update on Walmart Connect shows that while Walmart is asking brands for lofty spend increases next year, actual budgets are growing significantly slower, averaging ~30% vs. FY22. Vendors seem hesitant to increase investments at the pace Walmart seems to be asking due to less than stellar ROI and higher costs in other areas (like Walmart’s data package, Luminate). Additionally, our work suggests the Walmart Connect platform still leaves a lot to be desired, with brands’ biggest frustrations including: 1) inability to do creative A/B testing, 2) a lack of targeting precision, 3) slow processes to start campaigns, and 4) delays in reporting which slow ability to react and iterate in future campaigns. However, vendors testing The Trade Desk partnership have called out noticeable improvements here.

Source: Adweek

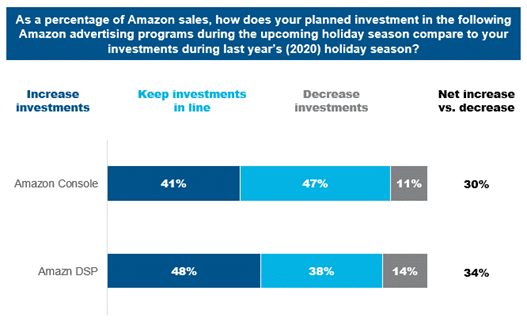

Brands investing more in Amazon Advertising this holiday season vs. 2020: According to our recent Amazon Supplier Benchmark, a net 30% of brands are increasing spend this holiday season on Amazon Console (aka AMS, paid search) as a percentage of sales, and a net 34% of brands are increasing Amazon DSP spend. This is despite severe supply chain challenges and cost pressures, illustrating how advertising has become table stakes on this platform. Advertising continues to become more important throughout the consumer’s path to purchase, and more competitive for vendors and sellers. Thus, while supply chain constraints are expected to limit the ability for brands to advertise, as we saw in 2020, our benchmarking data and anecdotal feedback from brands points to existing budgets being shifted toward products with healthy inventory levels rather than pulling back spend on an absolute basis.

Breaking it down by category, General Merchandise brands plan to increase investments this holiday season (as a percentage of sales) to a much greater degree than Food & Consumables brands. Given marketing budgets were cut substantially in 2020 for many General Merchandise brands due to in-stock challenges and financial constraints, these large increases in 2021 are likely more of a return to normal in spending rather than significantly raising the baseline level for advertising spend.

Source: CRC Amazon Supplier Benchmark, October 2021, n=98, 38 Food & Consumables respondents and 59 General Merchandise respondents