Target Supply Chain Fulfillment; Lowe’s Invests in Digital; Amazon Staffing

By Cleveland AdminAccording to our recent Target.com research, early supplier feedback has been positive on the addition of fresh and frozen items for Pickup and Drive Up, and Target seems committed to expanding this offering so that all stores are carrying fresh and frozen items for Pickup and Drive Up before the holidays. It also appears that Roundel will start offering campaigns specifically for fresh and frozen items on the Pickup and Drive Up platforms starting in 1Q21.

As Target expands this initiative, our research suggests buyers are limited on the number of items that can be listed as the front of stores are/will be limited in cooler space. Buyers are therefore looking to make the top 20% of items in fresh and frozen categories available for Pickup and Drive Up. Target has publicly released that they will have an additional 20,000 products (including fresh and frozen) available for pickup and delivery this holiday season compared to last year.

Source: Target

Lowe’s Making Moves to Improve Digital Experience:

This week Lowe’s announced that contactless pickup lockers will be installed in most metro market stores by Thanksgiving, and the company plans to expand this fulfillment option to all US stores by March 2021. The company stated that over 60% of its online orders are picked up in store. Lowe’s also announced at a recent industry conference that it will be rolling out more eCommerce fulfillment centers than it had initially planned for, as pandemic-driven shopping behavior changes dictate the need for greater investment. These new cross-dock terminals will help Lowe’s offer more same-day/next-day service, gain efficiencies across categories, and offer a broader assortment including longer-tail items.

We recently surveyed consumers on shopping experiences on seven key eCommerce sites, and Lowes.com ranked the lowest for delivery/pickup experience (8.1 out of 10 vs. the average score of 8.5). Of consumers that expect to purchase less items from Lowes.com a year from now, 32% pointed to a bad experience with ordering online and/or pickup/delivery. This compares to only 16% of consumers, on average, reporting a bad experience with the other retailers covered. Thus, our work suggests Lowe’s has some work to do to improve the consumer’s digital experience, and its investments in BOPIS lockers and eCommerce fulfillment centers are likely a step in the right direction if the company can execute it well.

Source: Lowe’s

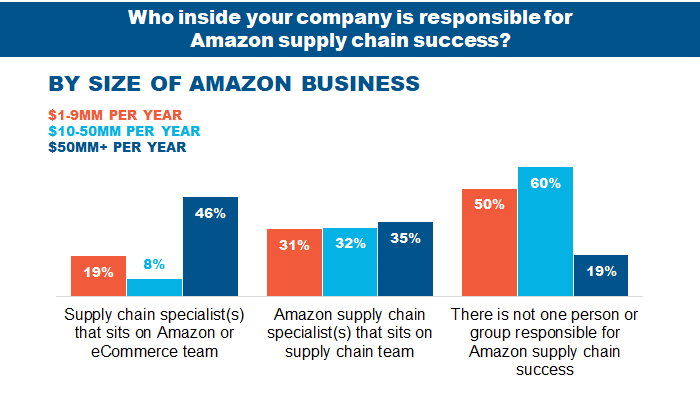

Dedicate Personnel to the Amazon Supply Chain:

Amazon is a unique retail customer, and with that comes a complex and constantly evolving supply chain system. For this reason, we find it effective for one person or team to have clear responsibility over Amazon supply chain initiatives inside manufacturer organizations. According to our recent Amazon Supply Chain Benchmark, the brands with the largest businesses on Amazon are most likely to have dedicated specialists for the Amazon supply chain, tending to have them sit on the Amazon or eCommerce team vs. the supply chain team.

Source: CRC 2020 Amazon Supply Chain Benchmark