Top AVN focuses: GMMs, SAS program, freight ; Brands increasing investments in 2022

By Cleveland AdminFor this week’s edition of 3 Things, we are highlighting our 2022 Core Amazon.com Platform Update, which takes a deep dive into Amazon’s 2022 AVN season so far.

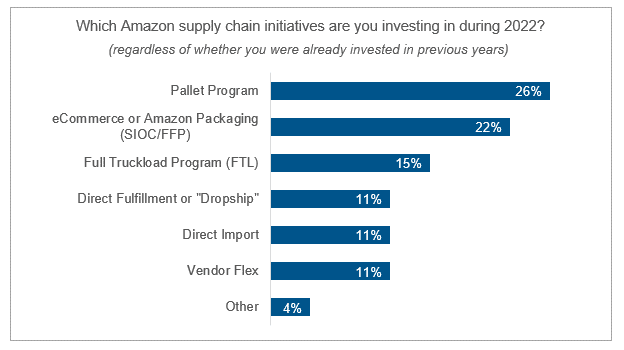

One of the top areas brands reported Amazon focusing on during AVNs is various supply chain programs. Last week we polled our community and found that 26% of brands are investing into Amazon’s pallet program, followed by 22% investing in eCommerce or Amazon specific packaging. Although eCommerce packaging is not typically a part of the traditional AVN conversation, it is encouraging to see that brands are making long-term strategic investments into something like packaging while still combating general supply chain issues.

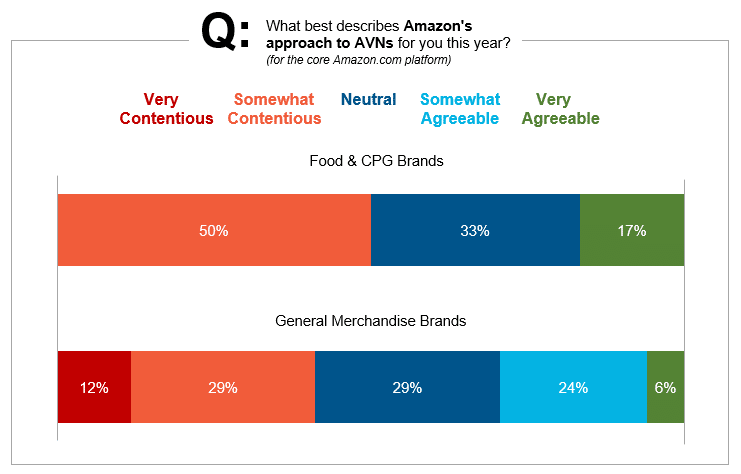

Brands have mixed feelings surrounding Amazon’s approach to AVNs this year:

Similar to last year, as of late January, 43% of brands are currently in the process of or have finished 2022 Annual Vendor Negotiations (AVNs) with Amazon. This compares to 40% at the same time last year. In terms of brand sentiment, half of Food & CPG brands describe the conversations as neutral to positive, compared to 59% of General Merchandise brands. Food & CPG brands’ perspective is in-line with 2021, but General Merchandise brands’ perspective is more negative compared to last year when 75% of General Merchandise brands viewed AVNs as neutral to positive. We believe the difference is likely due to brands looking to pass price increases on to Amazon to offset cost pressures. The number of brands and the magnitude of the increases are more significant in our research than we heard 12 months ago.

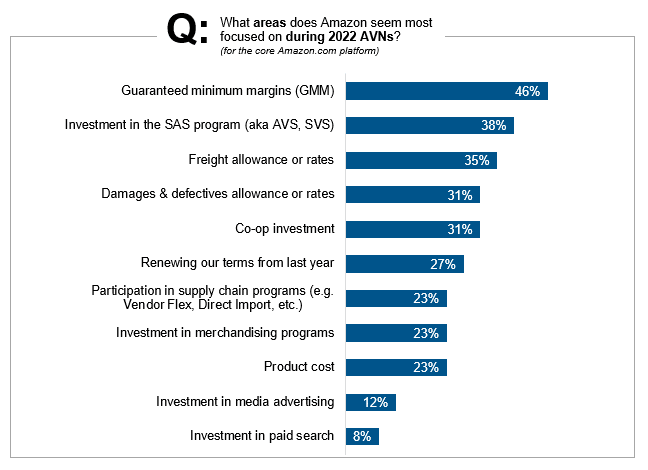

Top AVN focuses: GMMs, SAS program, freight:

This year it appears that guaranteed minimum margins (GMM) is the chief focus of conversations with Amazon. We have heard this theme in our broader research over the last several months in reaction to many brands trying to pass price increases to alleviate the pressure of rising costs due to the global supply chain crisis. Aside from margin protection, Amazon seems most focused on investment into the SAS program and changing freight rates. Breaking down by macro product category, it appears that the focus areas shift. 83% of Food & CPG brands reported Amazon pushing for investment in their SAS program and increased co-op investment. This compares to General Merchandise brands where SAS investment and co-op investment was only reported for 26% and 11% of brands, respectively. Instead, the top priorities for Amazon in relation to their General Merchandise brands are again GMMs (58% of brands), freight/damage rages (32% of brands) and interestingly enough, simply renewing terms from last last year (32% of brands).

Brands increasing investment into the core Amazon.com platform in 2022:

This year Food & CPG brands have increased investment into the core platform by ~13% for a new combined rate of 21.1% – 22.1%, compared to a 14% increase in 2021. Similarly, General Merchandise brands have increased their investments by ~3% for a new combined rate of 19.1% – 20.1%, compared to a 6% increase last year. Although this may look like a sizeable decline for brands, we still view their investment into the core platform positively. The slowing of these growth rates is natural given the proliferation of more omnichannel and emerging players, cutting the eCom pie even further. In our 2022 Performance Benchmark, we saw a similar story where brands are expecting Amazon to make up only 57% of their eCommerce business 3 years from now, compared to 60% pre-COVID.